JTC’s accounting and financial reporting services offer clarity, precision and peace of mind. Whether you are a JTC client or require outsourced accounting and reporting services for your business, we have the expertise and technology to deliver. Our global team of qualified professionals ensures your accounting needs are met efficiently and accurately, helping you stay compliant and giving you peace of mind.

Our accounting services for private clients include:

- Budget monitoring and preparation

- Cash flow forecasting and monitoring

- Financial forecasting and monitoring

- Management accounting

- Periodic reporting

- Granular consolidated reporting

- Statutory financial statement preparation

- Consolidated IFRS and GAAP accounting

- Bookkeeping

Keeping Up With Financial Reporting Requirements

Accounting and financial reporting solutions for private clients.

Find Your Local Team

Meet Your JTC Experts

Meet your JTC accounting team.

Frequently asked questions

JTC provides a range of services, including financial reporting, cash flow forecasting, bookkeeping management accounting, and consolidated IFRS and GAAP reporting.

Our team has extensive experience working across jurisdictions, ensuring compliance with international and local accounting standards while providing unified reporting.

JTC supports high-net-worth individuals, multinational corporations and trust entities with bespoke accounting solutions created for your unique needs.

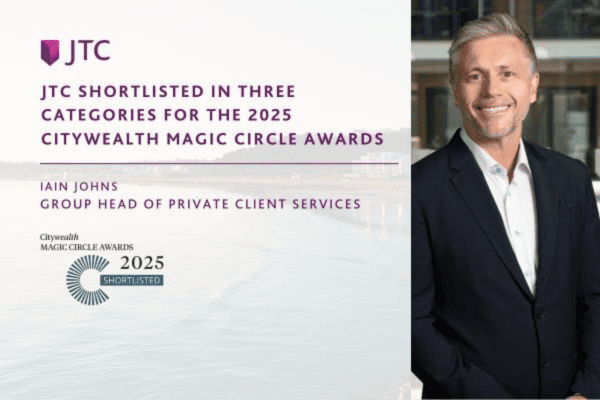

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Meet Your JTC Experts

Meet your JTC accounting team.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Meet Your JTC Experts

Meet your JTC accounting team.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Explore the Latest

JTC’s accounting professionals bring global expertise and local insights to support your success.

Let’s Bring Your Vision to Life

From 2,300 employee owners to 14,000+ clients, our journey is marked by stability and success.