As regulatory landscapes grow increasingly complex, businesses face mounting challenges in maintaining compliance while managing operational efficiency. At JTC, we work closely with you to streamline your financial and regulatory reporting. From financial statements to global compliance frameworks like AEOI, our solutions are designed to reduce risks and enhance precision. With JTC as your partner, you gain the confidence and clarity to focus on what matters most.

Meeting the Challenges of Financial Reporting

Outsourced reporting for business efficiency.

Find Your Local Team

Your Experts

JTC’s financial reporting specialists combine global expertise with personal commitment to your success.

Frequently Asked Questions

We provide a full suite of services, including accounting, management reporting, financial statement preparation, and regulatory compliance for global and local requirements.

Our team assist with FATCA and CRS reporting, economic substance reviews, and maintaining compliance with Automatic Exchange of Information frameworks.

Yes, we offer comprehensive tax compliance services, including Corporation Tax, VAT preparation, and iXBRL tagging for UK submissions.

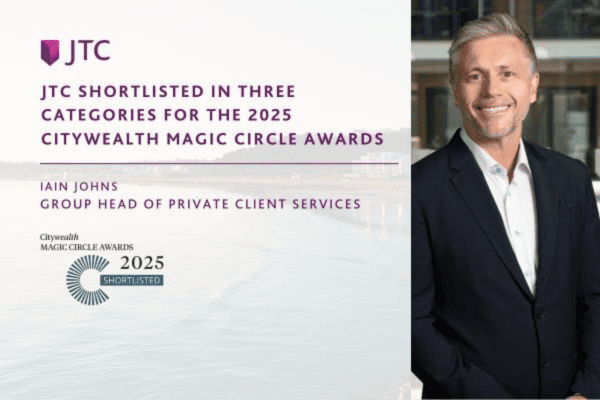

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Your Experts

JTC’s financial reporting specialists combine global expertise with personal commitment to your success.

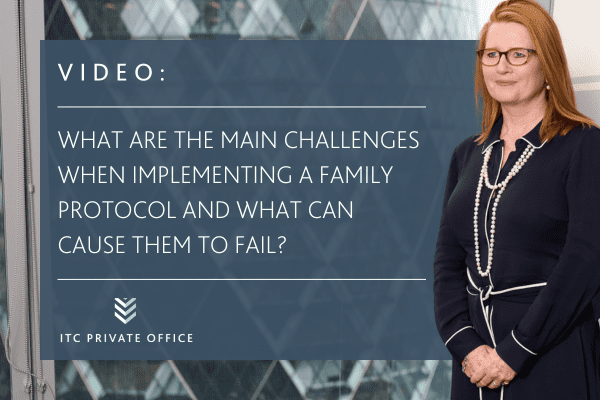

Insights from Our Experts

Insights from Our Experts

Your Experts

JTC’s financial reporting specialists combine global expertise with personal commitment to your success.

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Insights from Our Experts

Let’s Bring Your Vision to Life

From 2,300 employee owners to 14,000+ clients, our journey is marked by stability and success.