Results from JTC’s recent survey show investors want proof their investments are actually making a difference.

The term “ESG,” referring to Environmental, Social, and Governance considerations, has become a hot-button issue, and anti-ESG sentiment has grown in recent years based largely on the misconception that it’s impossible to consider impact without sacrificing returns. As JTC has learned through the responses to its 2023 Impact Investing Survey, the focus of conscious investors has become more sophisticated, and perhaps the broad terminology of ESG has outlived its usefulness.

What ESG is and what it isn’t

Since ESG first gained prominence as part of the UN Principles for Responsible Investment, its intention has always been good, but the problem with ESG has always been in its vague and broad nature. In attempting to cover a wide swath of considerations that affect companies of all types, the sector has grown so large that ESG has largely been rendered meaningless, making it difficult for investors who care about impact to find the types of investments they’re looking for.

A good example is ESG-based ETFs, which contain shares in companies that are selected for their commitments to ESG. This may attract investors who want to put their capital toward responsible companies, but as these ETFs are part of a secondary market and involve many companies doing many varied things, it’s impossible for the individual investor to actually see the effect their investment is having on the world.

As a result of this distance and vagueness in ESG, along with the proliferation of hundreds of reporting standards and accusations of greenwashing across the industry, many investors are dissatisfied with the ESG movement. Politicians who oppose any type of environmental consideration will never be in favor of ESG being employed by funds, even doing so has the opportunity to increase value, and investors who really care about impact don’t trust that their investments are having an effect. As a result, faith in ESG is falling, but for those knowledgeable investors who do care, there is a better way.

The rise of impact investing

Rather than focusing on all considerations at once, impact investments outline specific goals and focus on projects designed to bring about measurable outcomes. This focus on outcomes satisfies the investor demand of wanting to know where their money is going and whether it’s actually having an effect. There are impact funds doing incredible things to help struggling communities and the environment in the US and around the world, actions that rely on specific intention that goes beyond simply considering the environmental or social effects of company policy.

In fact, one of the biggest problems for impact investing has been its association with ESG. One of the lessons from JTC’s recent survey on impact investing was how many people think Impact and ESG are the same thing.

The 2023 survey contains useful insights on the subject of impact metrics and the wide range of concerns investors hope to target through impact investments. By addressing the question of how funds should quantify impact, the survey provides some clues as to what impact funds may look like in the future.

The survey report

Titled, “The Next Phase of ESG + Impact Investing is Here. Are You Ready?” the report is based on a wide-ranging survey conducted by JTC and OpportunityDb that included participants from across Europe and North America and covered a range of topics related to Impact & ESG, Opportunity Zones, and more.

One of the biggest shifts in investor attitudes that the report highlights is that for impact investors, diversification is not necessarily preferable. This is because rather than invest in bundled securities that cover all types of ESG-related industries, impact investors want to target specific projects with specific outcomes.

The report notes that “when it comes to impact funds, the majority of respondents (70%) prefer single asset funds to a blind pool fund – in other words, impact investors want to select the specific type of fund or cause in which they’re investing.”

Single-asset impact funds allow investors to choose the exact projects that match their passions. At JTC’s recent webinar, “The Evolution Toward Impact Investing: Rising Above the Noise,” Trisha Miller, Executive Managing Director, Capital Markets at Redbrick LMD, discussed how her company had “experienced this firsthand.”

With a single asset, she said, investors are “able to dig in and understand, ‘what is this project actually doing for the community?’” That way, investors can put their money toward the issues they care about and demand evidence that an impact is being achieved. “It’s not just one category; it’s a lot of categories that these projects can help improve and drive better outcomes.”

Those different categories are the key to understanding why a standard reporting framework or methodology is struggling to emerge. Why would an investor concerned with cutting carbon emissions evaluate an investment using the same metrics as an investor looking to expand internet access or veteran housing assistance? While the same project could contribute to all those ends, the different outcomes require different measurements.

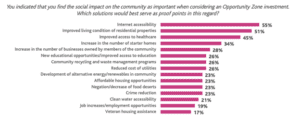

The survey asked Opportunity Zone investors which target outcomes would best serve as proof points for social impact. Look at the wide range of answers given:

“Individual investors have different passions depending on their personal beliefs, values and preferences, said JTC Group Head of Client Solutions Reid Thomas in reference to this chart. “While all of these are worthy causes, fund managers should expect that investor interest will vary depending on the target social outcome the fund is intending to achieve.”

As for what this means for the future, the report indicates that “as ESG and impact investing offerings continue to flood the market, the focus on particular, differentiated impacts that meet investors’ personal passions will be key.”

As the impact sector matures, it will no longer enough to say you’re attempting to make an impact or even to demonstrate that you’re putting investments toward projects with that goal. You need concrete results, and the way to differentiate in a crowded market is to provide the data that matters most to the specific investors who care about the impact goals of your fund.

How measuring outcomes will come to define impact reporting

Among the most useful portions of the survey report is a section entitled “Best Practices for Measuring Impact,” which covers important topics such as measuring outcomes, improving data collection, and focusing on security and transparency.

“Investors naturally want to know where their money is, what it’s doing, and when and where it’s being invested,” the report reads. “Finding a fund administrator with a user-friendly portal that offers regular reporting from any device, anywhere, can help.”

The right third-party fund administrator has an advantage when it comes to providing impact reporting because, as Thomas noted at the webinar, “there’s a surprising amount of information, in terms of impact, that can be derived just from the same activities that are going on within the fund anyway related to accounting and expenditures and so on.” In fact, he says, “impact reporting doesn’t have to be hard if you set things up correctly.”

The survey report outlines just how impact funds can tailor their impact measurements to meet investors’ particular passions:

As evinced by our survey, investors have a range of different interests when it comes to ESG and impact investing. Around sustainability, for instance, one investor might be passionate about reducing carbon emissions, while the other is concerned with improving sustainable farming techniques to reduce hunger. Though both fall under the umbrella of “sustainability,” they entail entirely different reporting and metrics.

At JTC, we’ve been doing targeted, focused impact measurement for years, creating purpose-built solutions for mission-oriented Opportunity Zone (OZ) and EB-5 funds. That’s no easy feat: reporting accurately at a smaller scale and measuring specific impacts to meet complex regulatory requirements can be a significant administrative burden.

The right way to tackle the increasingly niche and targeted world of impact funds, the report argues, is to treat impact funds like specialty funds. Working with a third-party administrator like JTC that specializes in impact funds across a range of investment types and impact goals means you can get solutions suited to your project’s specific impact targets.

“Traditional fund administration solutions don’t work,” says Thomas. “These funds have unique requirements that are best solved with purpose-built technology and specialized expertise. In other words, you need to use the right tool for the job.”

More from the report

The complete survey report includes a wealth of other data and analysis on topics such as generational attitudes toward OZ investments, how European and North American respondents have different conceptions of ESG and Impact, and how Opportunity Fund managers can do more to communicate the benefits of OZ investments. This report is a great way to understand the current state of Impact & ESG as well as where the industry may be headed in the future.

CTA: To download the full survey report, click below:

Stay Connected

Stay up to date with expert insights, latest updates and exclusive content.

Discover more

Stay informed with JTC’s latest news, reports, thought leadership, and industry insights.

Let’s Bring Your Vision to Life

From 2,300 employee owners to 14,000+ clients, our journey is marked by stability and success.