Financial Highlights

For the period 1 January – 30 June 2025

Organic Growth

H1 2024: 12.5%

EBITDA Margin

H1 2024: 33.4%

Leverage

H1 2024: 1.39×

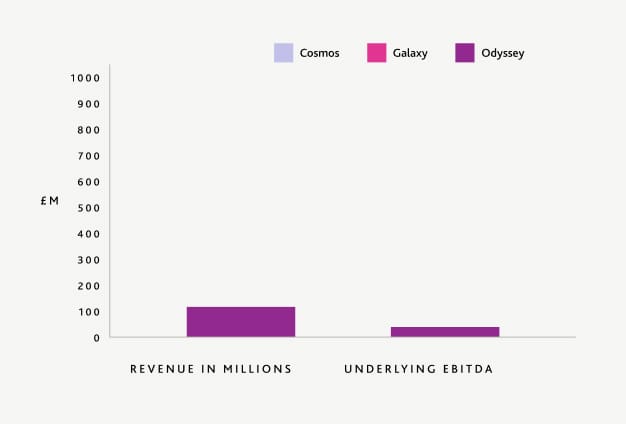

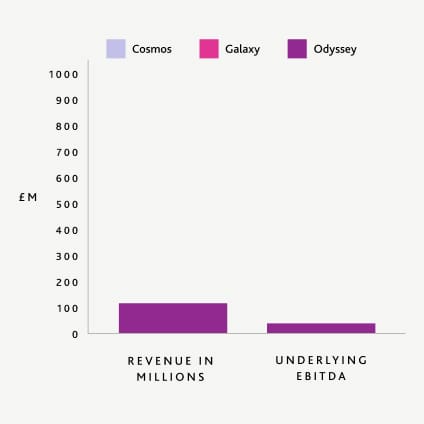

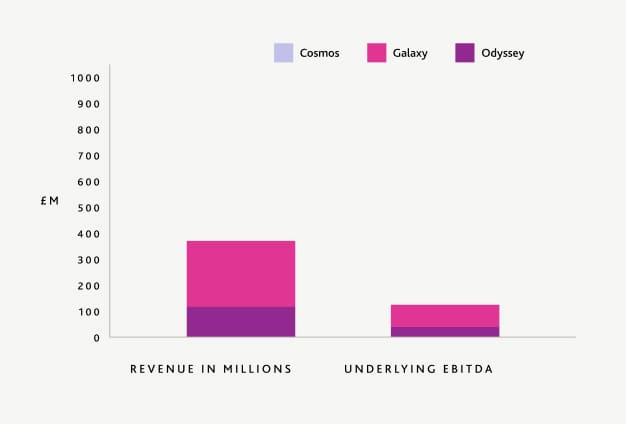

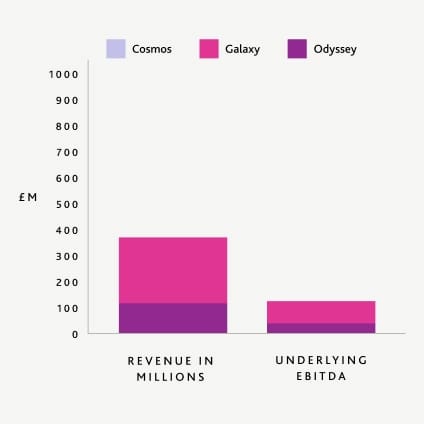

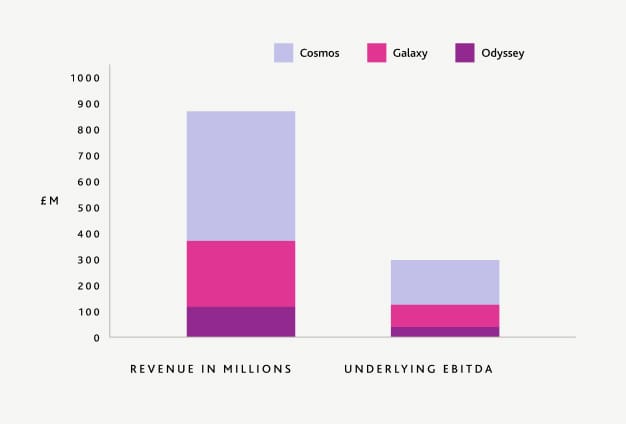

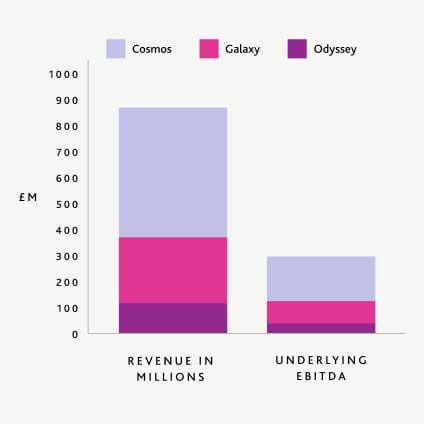

Revenue

H1 2024: £147.1m

Cosmos Era Guidance Metrics

Organic Growth p.a.

Underlying EBITDA Margin

Leverage

Cash Conversion

Company Overview

Our mission is to build long term relationships with our clients, enabling them to focus on their core business while we manage risk, protect assets and identify opportunities efficiently and cost-effectively.

8 Reasons to Invest

We have a 37 year history track record. We’ve combined organic and inorganic strategies to deliver consistent revenue and profitability growth.

Accelerating Together

We run JTC using multi-year business plans that we call eras. They are named for clear identity to support communication, strategic alignment and goal setting across the Group. Each era represents a step-change in growth, innovation and market presence. This forward-thinking strategy ensures that we remain resilient, adaptable and aligned with our long term goals.

Our Latest Financial Results

Access our most recent and all archived financial results presentations and webcasts.

JTC 2024 Full Year Results

JTC 2024 Half Year Results

JTC 2023 Full Year Results

JTC 2023 Half Year Results

JTC 2022 Full Year Results

JTC 2022 Half Year Results

Announcements

Read all our latest RNS updates and announcements.

Financial Calendar

Stay up to date with all our key financial dates, both upcoming and past.

Our Environmental, Social and Governance Framework

Our framework focuses on the objectives that are most relevant to our business; people, data and the environment. We have a number of non-financial key performance indicators that are tracked and reported in our Annual Report.

Shared Ownership

Staff Turnover

New Business Wins

Client Attrition

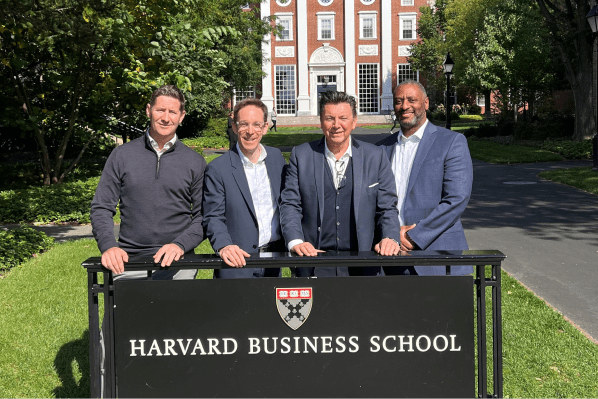

JTC Shared Ownership

Shared Ownership is central to JTC’s culture and success. Since 1998, our Employee Benefit Trust has aligned employee and shareholder interests and generated over £450m of total value for employee owners. This model empowers our people, supports our client-first approach and drives exceptional results.

Our programme is the subject of a Harvard Business School MBA case study.

Meet Our Board

Learn more about the Board of Directors who guide JTC’s strategy to ensure sustained growth and stakeholder value.

Subscribe to Receive Our Updates

Sign up to receive the latest financial news and announcements from JTC in your inbox.

Learn More

Discover how we create sustainable growth and value for all our stakeholders. Please get in touch with our team if you have any specific questions.