In the past US fund managers have been hesitant to look to the EU for new sources of capital and to diversify their investor base. Many perceive it to be too complicated, and therefore do not pursue it. Although fundraising abroad can present challenges, fund managers who follow the proper channels can realise great rewards. The EU is increasingly becoming a popular choice for fund managers when considering alternative capital and can be accessed in multiple ways.

In our view, there are three predominant reasons why US fund managers look to the EU when considering alternative capital.

Firstly, many US managers consider Europe in order to diversify their investor base from domestic US capital. Secondly, many investors in the EU and Europe see the US markets as an attractive investment proposition when analysing their portfolios for diversification. The third reason is that there is an abundance of European capital available for commitment to high performing US fund managers.

Non-EU fund managers typically take one of three approaches when thinking about how to access European capital:

- The first approach is the National Private Placement Regime (NPPR).

- The second is through reverse solicitation.

- The final approach is by establishing a fund within the EU and accessing the Alternative Investment Fund Managers Directive (AIFMD) marketing passport through an Alternative Investment Fund Manager (AIFM).

Each approach has its benefits as follows:

1. National Private Placement Regime

The AIFMD allows for third country based structures to gain access to the EU domestic market through Member States’ NPPR, which non-EU managers and structures have been utilising since the enactment of the legislation in 2013.

The NPPR refers to the process of registering a fund for marketing purposes in an individual EU jurisdiction. In this instance, the fund manager will likely have good knowledge of European markets and will have a targeted marketing strategy developed with regards to their European investor base.

The fund manager then proceeds directly to those target European countries and begins the regulatory registration process, which can take as little as 24 hours to a three month process depending on the EU jurisdiction. There are some EU member states, like France, where this is simply not a viable option due to local regulatory complexities.

The NPPR approach works extremely well for fund managers that have targeted a smaller number of EU member states, maybe three or four. Managers looking at more than half a dozen EU member states may find that the cost and time of registration and de-registration add up. A more suitable solution to managers who have yet to identify their investor base would be to establish a parallel EU fund.

2. Reverse solicitation

Reverse solicitation occurs where an investor directly approaches the fund promoter, seeking information about a fund or wanting to subscribe, having gained knowledge of the fund through an independent source. Larger fund managers tend to have existing relationships with European investors, so they may be able to successfully raise capital using this approach.

There are a large number of fund managers that access European investors through reverse solicitation as the approach is efficient and offers the benefit of a lower cost. However, when using this option fund managers need to have ample evidence to show that the Limited Partner approached them and that the fund was not directly marketed to them. In this instance, fund managers should consult with their lawyers to make sure that they are following all the necessary steps, and that the process has been properly documented.

3. Fundraising through an AIFM

The AIFMD is a piece of legislation that was introduced in Europe in 2013. Its purpose was to create a single set of rules for alternative funds.

The fund industry has seen great success in the use of the UCITS regime over several decades, and there was a desire to create a similar single framework for Alternative Investment Funds (AIF) and Alternative Investment Fund Managers to work in. This is what the AIFMD has sought to do.

The AIFMD has been in place now for several years, providing industry participants ample opportunity to fully grasp the fundamentals of the regulation and sufficient time to consider appropriate operating protocols. European regulatory authorities have also responded by implementing regulation at a local level to ensure proper application of the AIFMD rules. There has been a discussion recently about revising the AIFMD, and 2022 is the current target for this project.

The AIFM refers to the regulated entity under the AIFMD that takes responsibility for all aspects of the management of AIF and includes any asset class that one would not consider under the definition of traditional securities (e.g. private equity funds, real estate, private debt, fund of funds, and hedge funds). Liquid and illiquid alternatives are all covered under this acronym.

The AIFMD is a structured way of managing alternative funds. It is ideal for institutional type investors, such as insurance companies and pension funds, where the investors prefer a structure that is very well governed and the rules are clear.

An AIFM is the central concept of the AIFMD which allows an investment manager with no physical presence in Europe to use the AIFM’s “cross-border marketing passport” by establishing a relationship with an EU AIFM. In other words, the AIFM has the permission to market funds across Europe on a very simple basis.

This is desirable for fund managers who wish to access multiple European markets and they can utilise this by accessing an AIFM (either setting one up or using a third-party AIFM). Once this is done, the fund manager can notify numerous EU countries that they intend to sell their product or raise money in their markets, through a single notification to the EU regulator of the fund’s domicile. This is one of the primary reasons for the AIFM’s existence.

The other main role the AIFM plays is the day-to-day management of the fund itself. The AIFM typically handles everything involved with the management of the fund, including risk management, portfolio management, distribution and fund administration. The AIFM can retain these functions or delegate them to other service providers such as fund administrators, depositary banks, etc, but has a duty to retain overall responsibility for all functions. At the same time, it also retains the ability to provide oversight on behalf of the fund management clients.

As mentioned earlier, fund managers have two options for accessing an AIFM. Option one is to set up their own AIFM. This can be a fairly costly and onerous process, however the substance and technical requirements to obtain AIFM licensing are significant. Fund managers who are thinking about setting up their own AIFM need to understand that it is a line of business all of its own and if that is the type of business they want to be in.

Option two is to access a third-party AIFM. By signing up with the third-party AIFM, the fund manager immediately obtains access to a cross-border marketing passport. This gives fund managers the opportunity to develop their EU-domiciled funds, to market them and raise capital without committing too much capital or resources to Europe itself. The fund manager also has access to high-quality resources — people with hands-on portfolio management experience, risk management professionals and governance professionals that can also provide insight into the local compliance and regulatory environment.

In taking care of all the day-to-day needs of the fund manager clients, the third-party AIFM allows them to do what they do best: source deals, raise funds and structure their portfolios. It also gives fund managers access to top-level IT infrastructure. This is especially important for larger funds, where heavy risk management protocols are necessary.

Fund managers also have the option to consolidate fund services providers, using their AIFM institution to provide fund administration, domiciliation, depositary banking and other services.

Fund Structures for Alternative Investment Funds

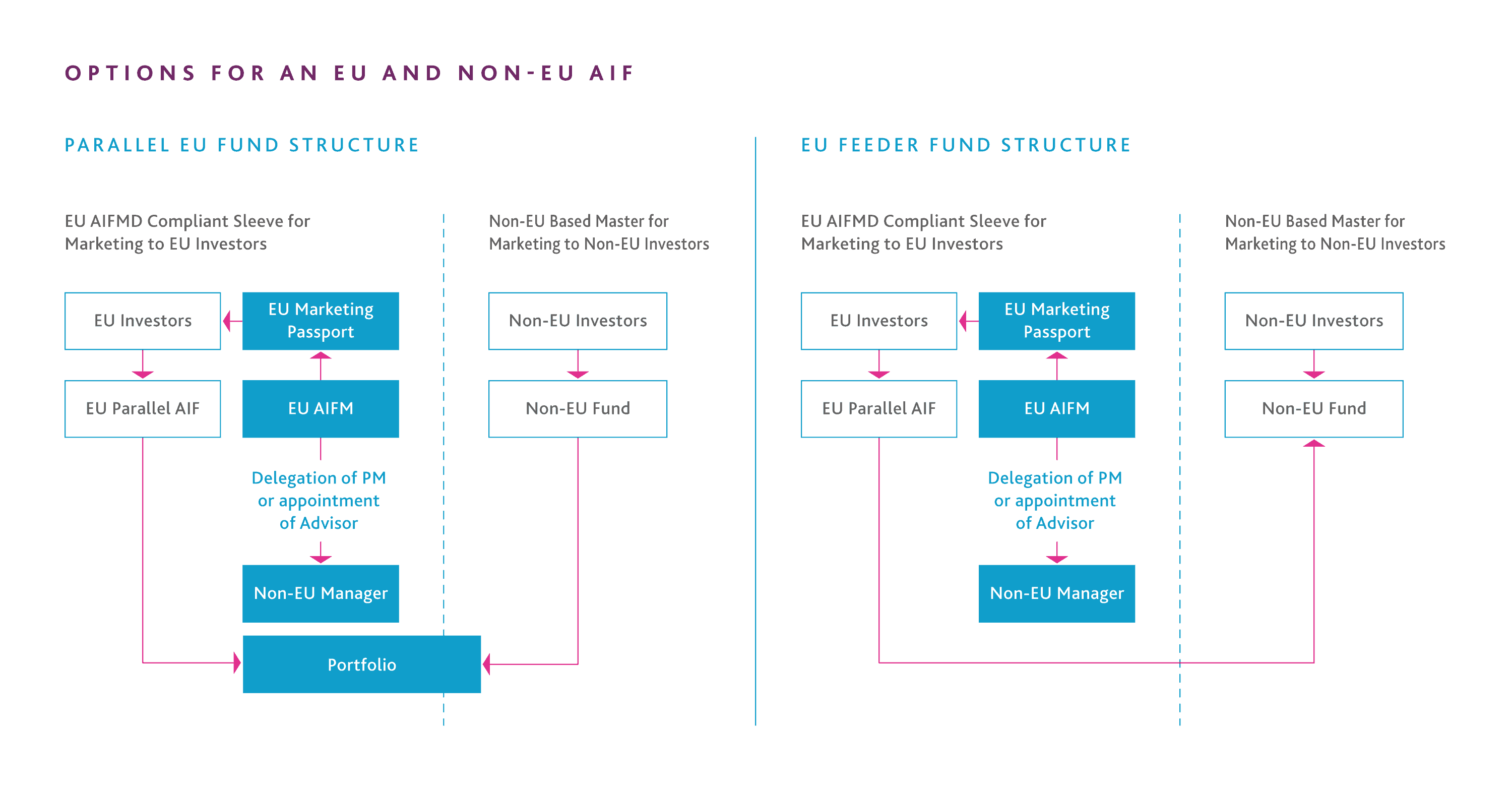

There are currently two popular structuring options under the AIFM. The first is a typical master feeder structure, shown on the right side of the graphic below. The second, which we are seeing more often now, is the establishment of a parallel structure in Europe that invests alongside a US domiciled fund, providing a route into this structure for EU investors.

What happens after marketing?

Overall responsibility for the marketing and distribution of a fund rests with the AIFM, with Distribution being one of its core functions.

The typical approach applied by an AIFM to meet these obligations involves an initial due diligence review and risk assessment of each distribution intermediary. Ongoing monitoring is then undertaken on each of these intermediaries through a combination of desktop reviews, gathering of KPI’s and on-site visits (the frequency and extent of which are dependent on the intermediaries’ risk rating).

In many jurisdictions there is also a requirement for the AIFM to issue a report to their local regulator at least annually, detailing all distribution intermediaries within their remit. For example, this report is filed with the CSSF in Luxembourg before the end of May each year.

Considering the options listed above it is essential that fund managers go through a deliberation process when deciding what is important for their fund strategy. They must consider where they want to acquire investors, where they are going to deploy capital, if it makes sense to fundraise in Europe, and how easy or challenging it will be to raise European capital.

To download a copy of this article press the download button below.

Fundraising In The EU

Key contact

Stay Connected

Stay up to date with expert insights, latest updates and exclusive content.

Discover more

Stay informed with JTC’s latest news, reports, thought leadership, and industry insights.

Let’s Bring Your Vision to Life

From 2,300 employee owners to 14,000+ clients, our journey is marked by stability and success.