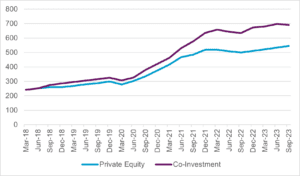

The Rise of Co-Investments

Stay Connected

Stay up to date with expert insights, latest updates and exclusive content.

Discover more

Stay informed with JTC’s latest news, reports, thought leadership, and industry insights.

Let’s Bring Your Vision to Life

From 2,300 employee owners to 14,000+ clients, our journey is marked by stability and success.