The European SPAC market continues to grow with Euronext Amsterdam taking the lead in the SPAC IPO listing charts, followed by Sweden, France and Germany.

Its surge has not gone unnoticed by the European Securities and Markets Authority (ESMA) and on 15 July 2021, ESMA issued a public statement to provide guidance on expected disclosures and risks surrounding investor protection.

ESMA statement

Due to the establishing of SPACs on many European listing venues and typical domiciles with different regulators, a variety of local structures and regulatory requirements are currently under development. In its statement, ESMA calls for a coordinated approach on prospectus disclosure requirements and application of MIFID-product governance rules with a focus on the participation of retail investors.

ESMA encourages all national competent authorities to scrutinise SPAC prospectus disclosures on several items:

- Risk factors

- Strategy and objectives

- Escrow accounts and reinvestment of IPO proceeds

- The experience of administrative, management and supervisory bodies

- Conflict of interest – Sponsors

- Shares, warrants and shareholders’ rights

- Major shareholders

- Related party transactions

- Material interests

- Information on the proceeds of the offer

- Information on the intention of certain persons to subscribe in the offer

- Information on offer price

In addition, ESMA expects the inclusion of supplementary information to ensure a satisfactory level of investor protection in line with the prospectus regulation.

Disclosures on the future remuneration, role and shareholdings of the SPAC sponsors, potential governance changes post-business combination and possible scenarios that may arise if the SPAC fails to secure the desired business combination should be included in SPAC prospectuses.

In our experience, the prospectuses of the SPACs we service contain detailed and comprehensive disclosures on the items listed by ESMA as approved by the local regulators. Extensive disclosures on risk factors, related parties, shares, warrants, strategy and objectives are already market practice among top-tier offerings.

It remains to be seen whether the relevant national competent authorities find the current level of disclosure sufficient to enable informed investment decision-making at each stage in the lifecycle of the SPAC, or if they will add another layer of scrutiny as a result of ESMA’s statement.

Regardless, it is clear that ESMA seeks to increase transparency on the mechanics of SPACs including corporate governance and conflicts of interest. It is looking to ensure that only high quality SPACs enter the market and that investors will be protected against wrongful behaviour of SPAC operating teams that could hurt investor interests.

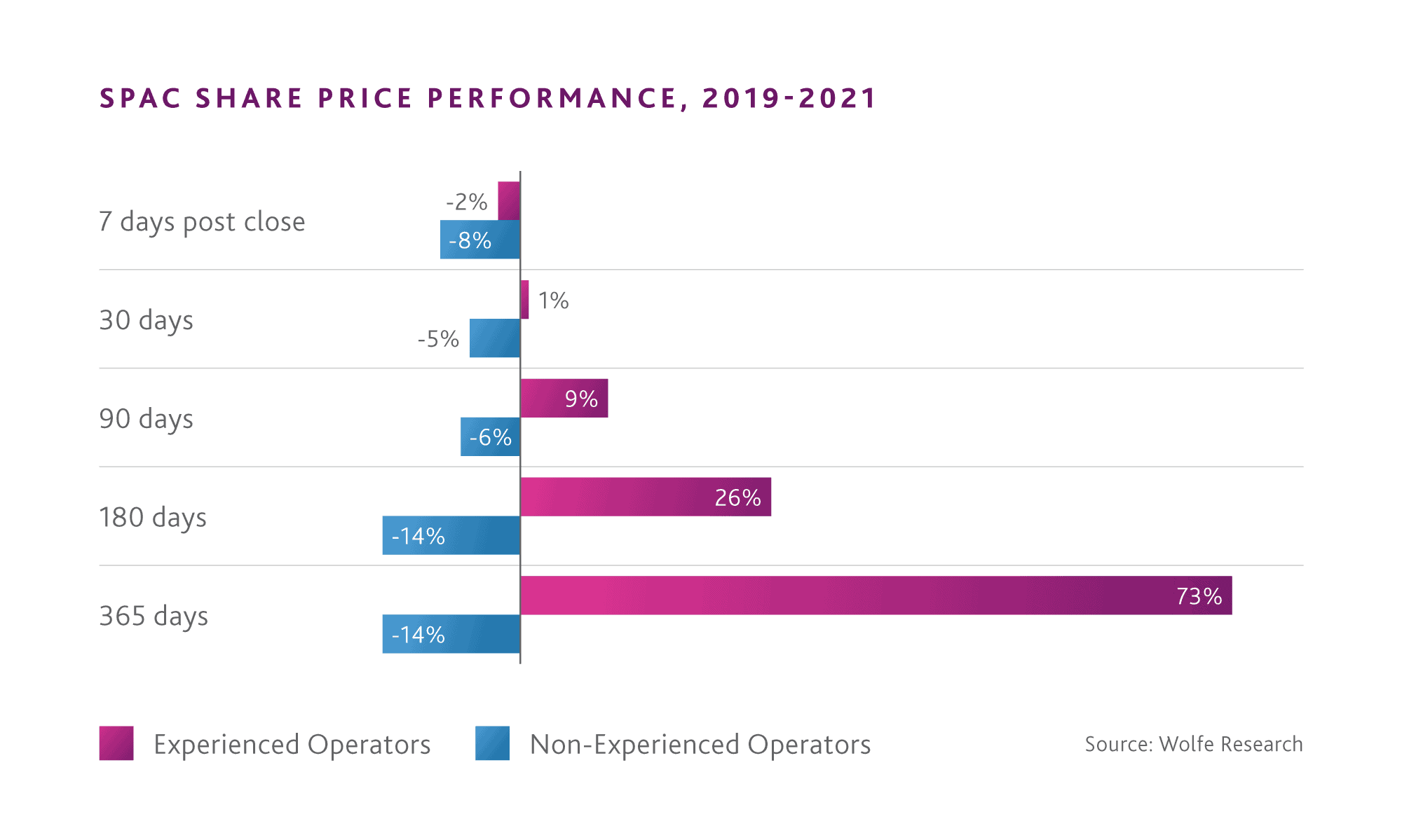

This focus is understandable. In a study by Wolfe Research, US SPACs with an experienced operating team outperformed their less experienced peers substantially.